With the start of the new year, many of us take stock of where we are and what 2018 holds in store.

The status of U.S. hotels partly depends on the lens you’re looking through-whether you’re a franchise company, developer, owner, operator or investor. While the opportunities and strengths of one perspective could be a threat or weakness to another, these items contribute to the big picture, regardless of your role in the industry.

Strengths

Record occupancy: U.S. hotel occupancy of 65.9% in 2017 is the highest since STR began recording U.S. lodging performance in 1987.

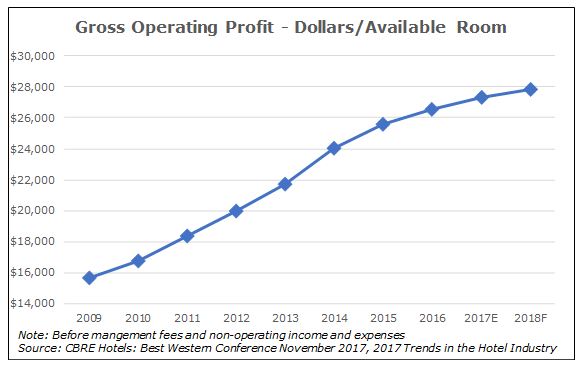

Gross operating profit: GOP per available room before deductions for management fees and non-operating income and expenses has increased almost 70% from 2009 through 2016 to $26,520. CBRE projects an increase of 3% for 2017 and 1.8% for 2018.

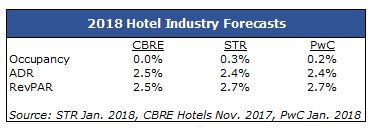

2018 forecast: Revenue per available room is projected to increase in 2018, which would be the ninth straight year of growth.

Low interest rates: Even though the Federal Reserve raised interest rates three times (0.75% total) in 2017 to a target of 1.25% to 1.5%, rates are historically low and contribute to a favorable financing environment for development and acquisitions. Per the Federal Reserve Bank of St. Louis, the midpoint of the projected target range for the federal funds rate is 2.1% in 2018, 2.7% in 2019 and 3.1% in 2020. Since 1990, the federal funds rate has been as high as 8.25%.

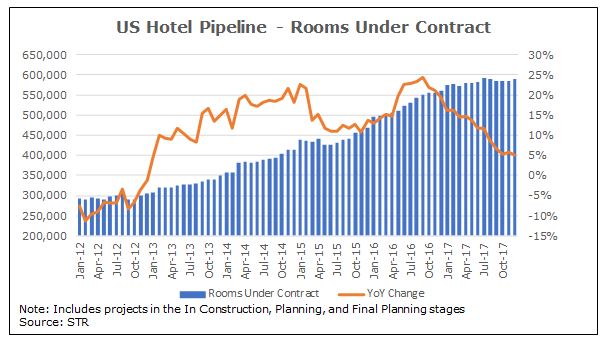

Robust development pipeline: There were 588,645 rooms under contract in December 2017, which includes those in the in construction, planning and final planning stages. This is only 0.5% from the high of 591,865 in July 2017 and 100.8% higher than in January 2012.

Weaknesses

Robust development pipeline: While a large pipeline is good for franchise companies and developers, it can negatively affect existing hotels by causing market occupancy to decline.

Decelerating development pipeline: Even though the development pipeline is robust, the growth rates for the number of rooms under contract and those in construction (included in under contract rooms) have been in downward trends since September 2016. While rooms under contract continue to increase year-over-year, October 2017 marks the first year-over-year decline in the rooms in construction since late 2011. In December 2017, rooms in construction declined year over year at 3.7%.

Waning RevPAR growth: The RevPAR growth rate has declined each year since 2014 and is projected to continue its downward trend in 2018.