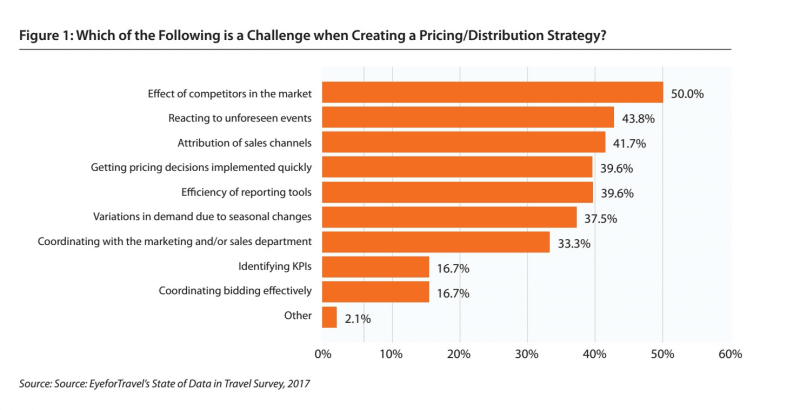

A new report from EyeforTravel delves into ways that revenue managers can aggregate data streams more effectively

The impact of competition is the biggest headache facing revenue managers tasked with creating pricing and distribution strategies, finds EyeforTravel’s latest report – Aggregating Data Streams for More Effective Revenue Management report. In fact, half of the revenue managers surveyed said that their competitors create difficulties when trying to set their own pricing strategy. Unforeseen events are the next biggest challenge for 43.8% of respondents, followed by attribution of the sales channel. The challenge of accurate attribution is an issue that comes up time and again in EyeforTravel research.

In the past five years, predicting and measuring the impact of the competitive landscape has become increasingly difficult. That is down to the rise of hotel comparison sites, which have made it easier for consumers to compare hotel prices and products. In addition, the growing number of alternative accommodation websites has introduced a new stream of supply into many markets.

So, what can revenue managers do to understand their competitors better, and maximise their property’s performance in competitive markets?

1. Build a comprehensive competitive set

This ‘compset’ should look at more than the just proximity of other accommodation options. Revenue managers should go further to understand their own property attributes and the type of guests it attracts. It should use this compset take on rivals, which are fighting for the same customer.

2. Set prices carefully

When it comes to setting, and specifically dropping, prices, the report urges caution. It notes that numerous studies have found that reducing prices in order to compete can cause long-term damage. Overall, properties that maintained higher average daily rates (ADRs) performed better; the impact of cutting prices did not boost occupancy sufficiently to make up for the shortfall in income. Furthermore, consumers do not view prices rationally, as choosing accommodation requires them to consider a whole range of factors. Interestingly, a lower price may even indicate poor quality accommodation to some consumers.

3. Consider the unique advantages of each property

Hotels need to consider the individual advantages of their property, and only consider the nearest competitors that are most likely to be vying for the same customer. And here is a word of warning: if you choose to go head-to-head on price, then hotels should not attempt to undercut the direct competition by more than 5%.

“It is natural, almost reflexive, for revenue managers to try and bring prices down to below their competitors, especially if their booking window is not where they want it to be,” says Alex Hadwick, Head of Research at EyeforTravel.

However, EyeforTravel’s findings suggest that this could make the future more difficult revenue managers when they look to raise prices.

“This especially true as the role RM is shifting away from just setting rates to working across the business to measure profitability and sell ancillaries more effectively,” Hadwick stresses.

While competitive pricing can be useful, 71% of revenue managers believe the discipline should be viewed more holistically and recognised as revenue management. Indeed, revenue managers need to be thinking about all of their property’s features and not just trying to be $10 cheaper per night than their rivals.

The report is free to download and also considers:

- The effect of competitors on pricing, how to account for them and what strategies to take to get a competitive edge.

- Understanding and constructing predictive analytics.

- Understanding the costs of a business’s channel mix and how to win direct bookings.

- The state of the industry’s approach to ancillary revenues.

- The key metrics every revenue manager should be working toward.

- The future of a revenue manager’s role and the skills they will require.