Guest satisfaction has consistently improved, but are hotels getting better or are guest expectations shifting?

NB: This is an article from Shiji

Subscribe to our weekly newsletter and stay up to date

With AI-driven experiences, personalisation, and evolving service models, could we see a new benchmark for what “good service” actually means in 2025?

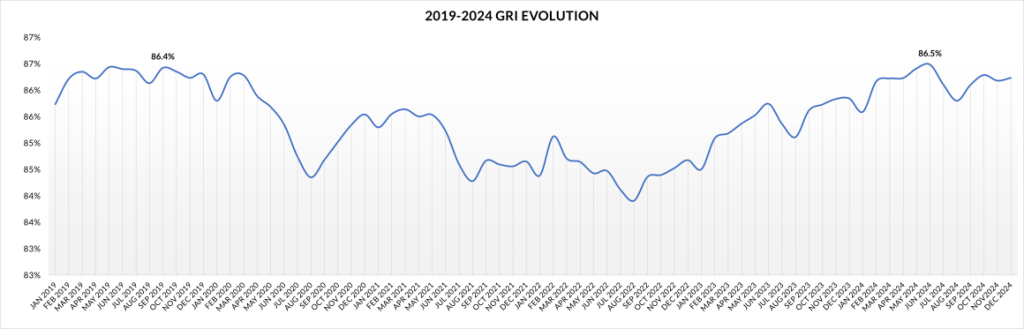

Guest satisfaction has been growing since the beginning of Q3 2022. Whether this is mainly the long-tailed effect of the market bouncing back from the Covid pandemic is disputable, but several indicators hint at that. The GRI evolution shows that pre-COVID patterns are reinforcing, such as the peak season drop around August and the subsequent bounce back, a typical pattern of the pre-COVID era.

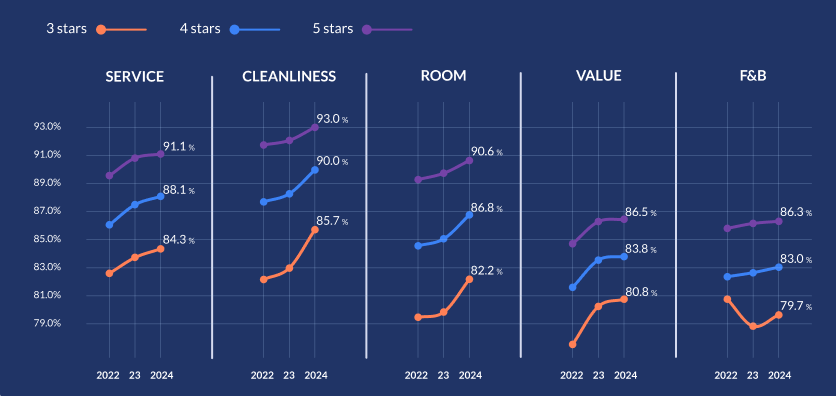

At the same time, data is telling us that expectations are shifting. This can be seen in the Value for money index trend evolution, for instance, which points out that the perception of this ratio has changed quite dramatically in 2024; indeed, many regions are experiencing a trend reversal (Europe, Latin America and Africa). No other major department score recorded such an abrupt stop to its positive trend.

Global Department Score trend evolution (2022-2024) for the major Hotel departments.

Alongside all the other data points we collected, the bigger picture could be read as the guest experience shifts towards a more personalised one, thanks to the increased ability to collect and parse out data but with the limitation of market elasticity. A likely contributor to the latter is the short-term rental market, which pressures hotels with their ever-growing availability and price dynamics. Indeed, a good service includes key parameters such as room and facility cleanliness, qualified Staff and a room that does live up to the expectations the rates suggest.

Mid-tier hotels are winning in reputation

Luxury hotels dominated reputation scores for years, but now mid-tier hotels are making the biggest gains. Is this a sign of improving service standards, or are travellers prioritising value and experience over prestige?

Five-star hotels are indeed likely to face a more challenging environment as the recent inflation spike led to a further increase in rates, which, in turn, raised expectations even higher. Another factor is staff turnover. Though less relevant than before, this still affects the 5-star market. Data tells us, in reality, that while the luxury market has been able to contain the guest satisfaction loss caused by the COVID-19 pandemic, 4-star and 3-star properties GRI’s kept dropping up until August 2022.

Therefore, a more vigorous bounce back is now taking place for the mid-tier hotels, compounded by the rising rates that allowed them to attract some of the 5-star guests and grow their GRI faster than the luxury market.

Review volume is declining

Google and other platforms have ramped up efforts against fake and incentivised reviews, leading to a drop in total reviews. Will these measures reduce guest engagement or lead to more meaningful feedback?