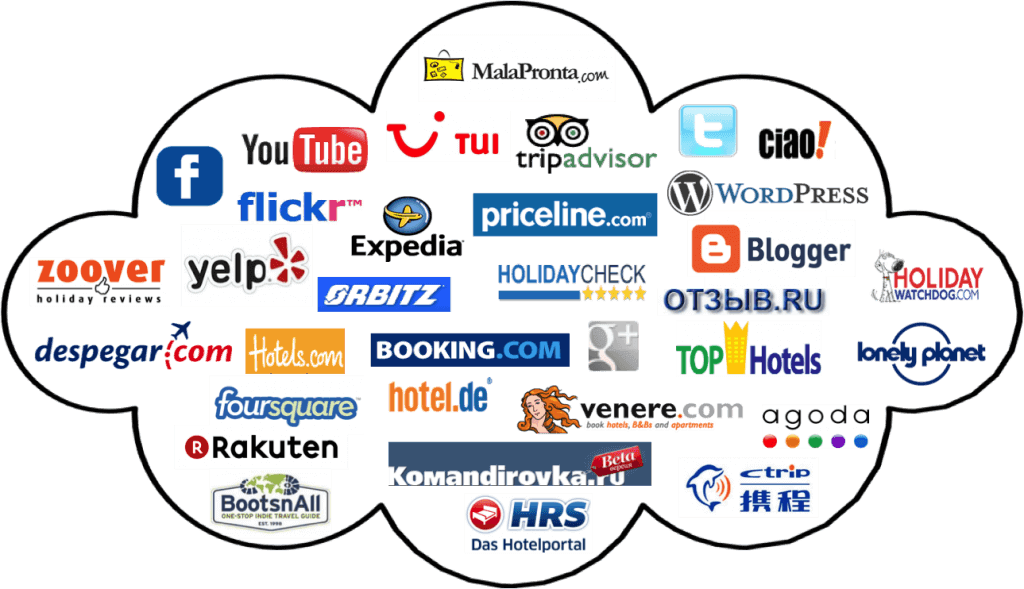

One of the most beneficial impacts of the expansion of hospitality technology has been a wealth of distribution channels for hotel inventory. Hotels can now be extremely targeted when it comes to distribution, adjusting pricing and availability in individual channels to more profitably yield their room inventory. On the flipside, hotels can choose a channel-agnostic strategy and rely on a few partners with global scale to distribute inventory.

NB: This is an article from OTA Insight

The simultaneous proliferation and consolidation of channels have downstream impacts, where rates may flow from directly contracted channels (such as a hotel with a GDS contract) to uncontracted third-party channels out of the hotel’s control. The resulting opacity adds layers of additional complexity to an already-complex distribution landscape and provides cover for bad actors to take advantage of the situation.

“The way hotels sell rooms is not the way they used to. Blended distribution is adding some friction and scariness to the world. You can’t always tell who the actual supplier is, or who the source of the business is.” – Lew Harasymiw, Director, Distribution Strategy – Connectivity at IHG

In a recent panel this past month at HEDNA Los Angeles, colleagues from CWT, Sabre, Kimpton, and IHG joined OTA Insight’s Clive Wood, Global Commercial Manager for Parity Insight, to discuss the realities facing hotels when it comes to today’s model of blended distribution. From the challenges to the opportunities, here’s how hotels can maintain some level of control in a blended distribution world.

The challenges of blended distribution

Blended distribution is advantageous because it boosts a hotel’s visibility across multiple channels, increasing the likelihood of a customer finding and booking its rooms. However, it also pushes far more queries into the ecosystems, muddying the waters as far as where inventory is coming from, who the source of disparity is, and how to price rooms advantageously.

The more blended the distribution, the harder it is to control your inventory and the more opportunity there is for bad intermediaries to play close to the line (or below the line). These players create value primarily through price, which threads throughout the three core challenges created by blended distribution:

- Managing customer acquisition costs (CAC)

- Maintaining rate parity

- Protecting the customer experience

Without clear attribution, a hotel doesn’t always know how a particular room rate came to be available on certain intermediaries. Without knowing the source, a hotel can’t know how much it pays out for a booking on that channel. Without this information, a hotel can’t calculate the true customer acquisition cost, which skews any profitability metrics.

In addition, losing control of inventory affects a hotel’s efficiency. There are additional technical costs of managing more inbound queries, and it’s hard to build sufficient infrastructure for all the eventualities. There’s also the potential to skew analytics in relation to demand trends, booking patterns, and conversion rates.

The reduced visibility of the supply chain is a huge drag on hotel distribution systems, says Wood:

“It’s safe to say that we, as an industry, don’t have full visibility into the supply chain. So how can we build system efficiency if, for example, there’s a metasearch channel that returns non-authorised OTA inventory from an OTA that the hotel doesn’t work with directly? Factor in that the OTA could be requesting ARI from multiple wholesalers for the same hotel for the same date. Which means that the hotel or CRS could receive multiple requests from essentially the same potential guest.”

Blended distribution also has implications for rate parity. Not knowing the supplier makes it difficult to rectify any disparities, which leaves the hotel vulnerable to breakage and missed targets. The only way to truly know the source of a booking requires time and patience; after a test booking is made, the culprit can be identified. Test bookings are hard to do at scale without the assistance of professional services, which magnifies the negative impacts of disparities related to blended distribution.

Finally, potential guests are also affected. If there’s a channel that offers a rate lower than others, it tends to convert. It also tends to encourage consumers to return to that channel in the future. The potential erosion in trust and conversion for the direct channel is an immeasurable downside to blended distribution.

Back to the (distribution) basics: Mass, selective, or exclusive?

To thrive in the face of these challenges, hoteliers have to go back to the basics of distribution. Each potential channel partner should be evaluated according to its own distribution strategy, and existing partners must be regularly reviewed to catch any growing misalignment, says Wood:

“A hotel must monitor its channels on a daily basis to maintain a firm understanding of its actual distribution. Things change constantly, so the only way to maintain control is to pay attention to these changes every day.”

Since blended distribution is a pervasive issue, hotels must manage distribution more than ever. Hotels must fall back to basic distribution/marketing management principles of mass, selective or exclusive:

- Mass: Push inventory out to as many channels as possible with a focus on volume and visibility.

- Selective: Control access to inventory through select partners with a focus on conversion and pricing.

- Exclusive: Limit access to inventory through a few partners with a focus on matching the hotel to the right guests.

If you want more control, you have to be selective. And if your hotel is selective, but your selected partner has a mass distribution strategy, then you have a problem. Each of your channel partners should fulfil a piece of your hotel’s distribution strategy, rather than fight against it. Plot your strategy and then identify the channels that provide a clear value to your chosen strategy. Use of the right technology will boost your efficiency. Adds Wood:

“Don’t neglect your reporting. It’s important to benchmark your progress across channels so that you can track progress and measure improvements.”

When a hotel knows its actual state of parity by shopping extensively across channels at regular intervals, it’s well-positioned to be a competitive player in its local market. Emerging channels can mean lucrative new opportunities; but without a foundational distribution strategy that builds off the basics, opportunities can quickly turn into threats. Hotels must insist on robust contracts that create accountability, monitor channels aggressively, and work to consolidate distribution to limit unauthorised blending.