In recent weeks, news of airlines cancelling flights and images of long queues at European airports have dominated mainstream media, with many travellers reported having missed their flight due to lengthy delays even after check-in.

NB: This is an article from ForwardKeys

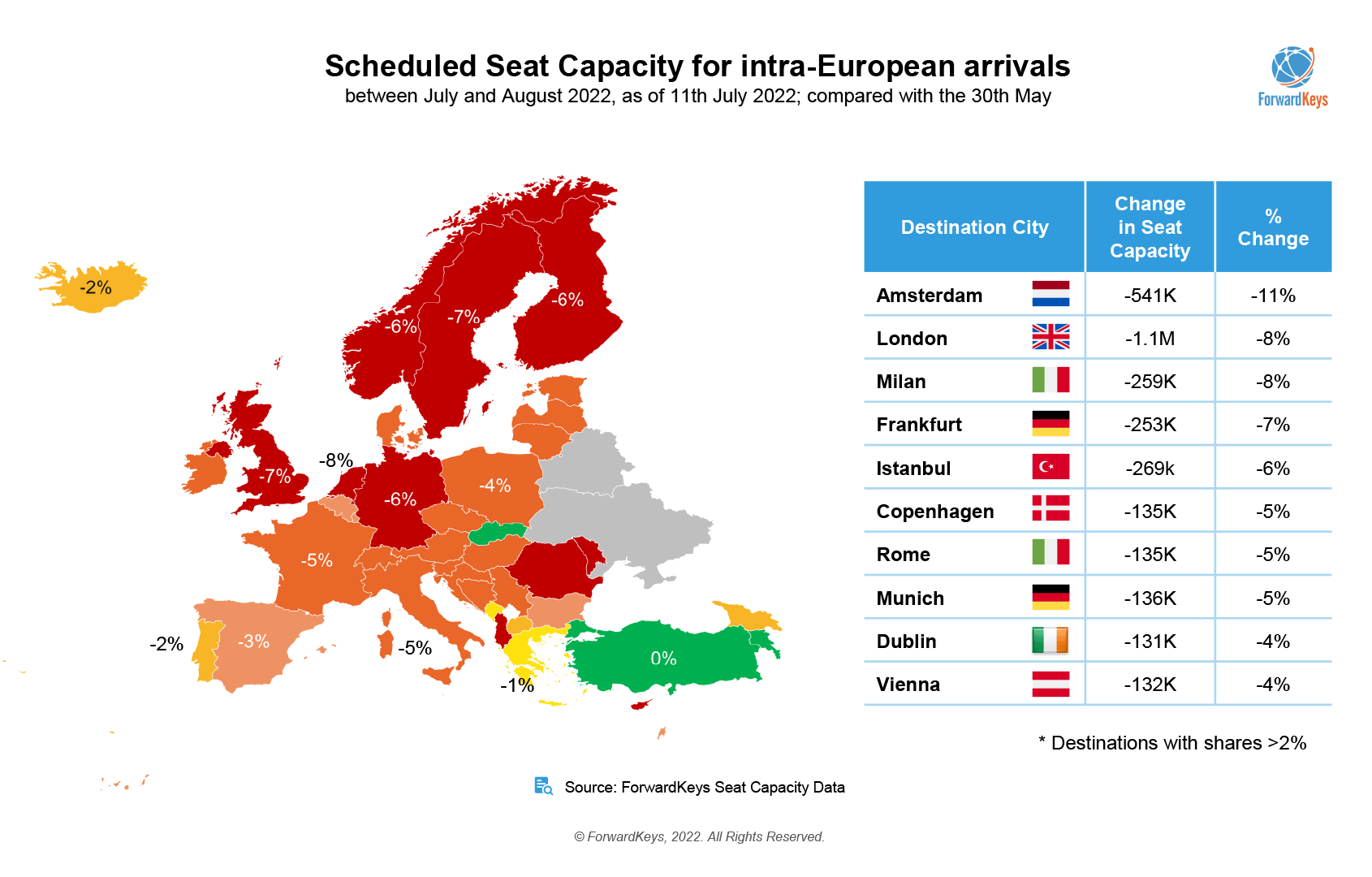

To shed light on how bad the situation really is, ForwardKeys has taken a closer look at air traffic disruption by analysing recent cutbacks in capacity around the world. Our analysis began with a comparison of the number of scheduled seats available in July and August, as of 30 May, with the situation six weeks later, on 11 July.

Subscribe to our weekly newsletter and stay up to date

The bottom line is a global reduction in capacity of 4%, which equates to 14.3 million seats. The continent worst affected in relative terms is Asia Pacific, which has seen capacity cut by 10%, or 4.6 m seats, followed by Europe – the worst affected in absolute terms – with a capacity reduction of 5%, or 9 m seats. The Americas have lost 2%, 1 m seats. In Africa and the Middle East, capacity is almost unchanged.

Cancelled flights by European destination city

A closer look at Europe reveals that scheduled intra-European airlines seat capacity has seen a reduction of 5% across the continent, with the Netherlands and the UK experiencing the largest reductions, at 8% and 7% respectively. These are followed by Sweden at 7% and Germany at 6%. An analysis of the major European destinations (those with a market share of 2% or greater) reveals that Amsterdam is the capital of air traffic disruption, having experienced a 11% drop in seat capacity for July and August. It is followed by London and Milan, down 8%, Frankfurt, down by 7%, Istanbul down by 6% and then by Copenhagen, Rome and Munich, all down by 5%.

Cancelled flights by carrier type

In general, legacy carriers have experienced slightly larger capacity reductions (-6%) than low-cost carriers (-5%), but it is a low-cost carrier, EasyJet, that tops the list in absolute terms for cancelled flights, with a reduction of 9%, equating to 1.4 m seats.

Read rest of the whitepaper here