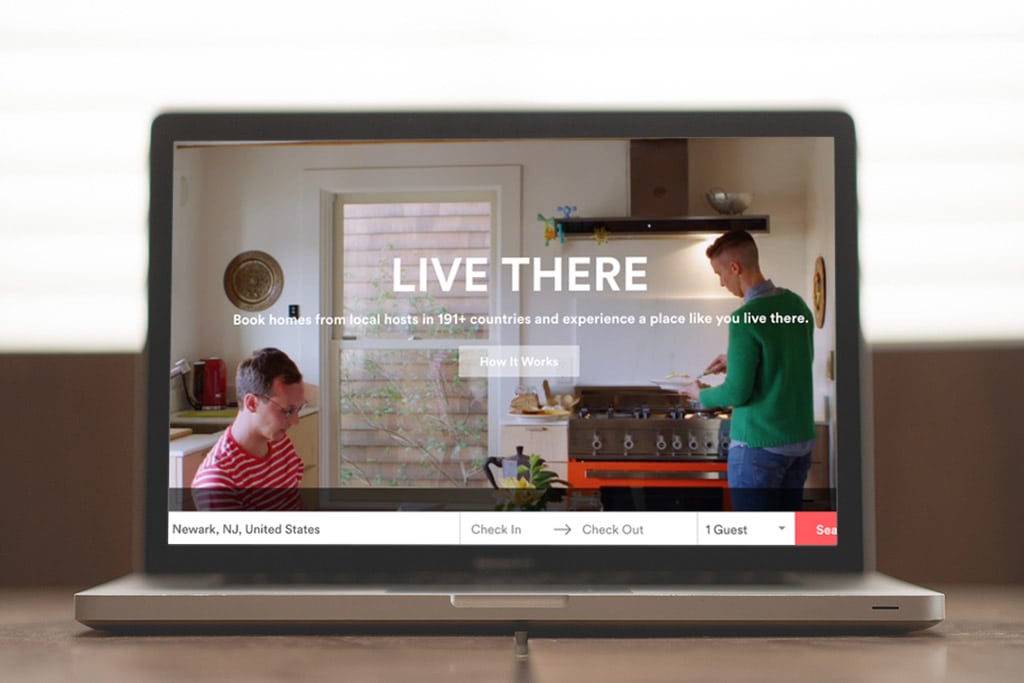

In less than a decade Airbnb, the San Francisco-based home-sharing platform worth an estimated $25.5 billion, has become one of the biggest disruptors in the travel space.

And the industry for whom Airbnb has been the most disruptive — hospitality — is keeping a very close watch on the company’s every move.

Every day, there seems to be a new headline suggesting the hospitality industry’s demise at the hands of short-term rental sites like Airbnb.

On May 16, a New York City budget analysis highlighting a 4% drop in hotel occupancy taxes from October to March delivered the following headline: “Websites like Airbnb blamed for drop in revenue from NYC hotel tax.” It’s not the only factor: the city of New York is in the midst of a glut of new hotels both in development and under construction; 126 new hotels are slated to open in the city in 2016 and beyond.

On May 19, Bank of America hospitality analysts announced they were downgrading their suggestions from “buy” to “neutral” for hospitality stocks like Hilton and Hyatt, primarily because of threats like Airbnb.

In February, media outlets reported the findings of a survey conducted by Goldman Sachs that seemed to suggest once someone stays in an Airbnb, they don’t want to go back to staying in a hotel. But if you look closely at the survey results, you see more consumers prefer hotels to peer-to-peer accommodations or have no preference. Of those who’ve stayed in an Airbnb or similar accommodation before, a majority (40%) still prefer hotels, while 36% prefer peer-to-peer accommodations, and 24% have no preference.

But is it really taking away market share from hotels? That’s a question looming on every hospitality executive’s minds these days and, judging by the latest survey from the Pew Research Center.

Released on May 19, “Shared, Collaborative, and On Demand: The New Digital Economy,” takes a comprehensive look at how sharing economy companies like Airbnb are impacting Americans, as well as what Americans’ views and perceptions are regarding these disruptors.

Read rest of the article at: Skift