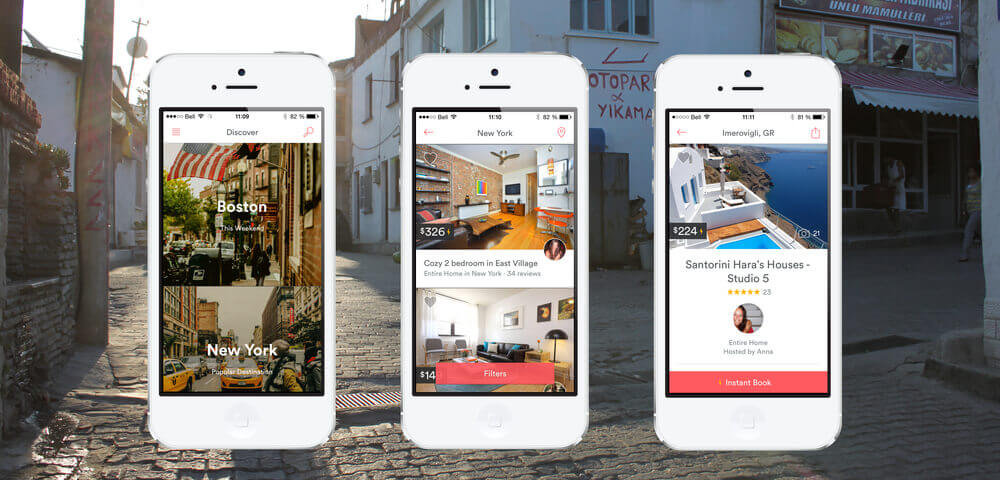

The vacation rental business is currently worth $100bn but Airbnb is reportedly still not profitable, and the competition is growing.

Cities may be fighting to restrict it, but the Airbnb genie is out of the bottle! London and Amsterdam have just become the latest cities to push back on Airbnb growth ambitions. In New York a deal was struck a few days ago to curb hosts’ large-scale rentals that are in effect unofficial hotels. Canada and Japan are among the many other countries seeking to enforce limits (or impose taxes). Yet, with more and more peers emerging, will this really limit the squeeze on badly needed city housing ease the competitive pressure on hotels?

‘Airbnb’ is becoming a generic term, the list of companies in the vacation rental market growing all the time. Even in a tiny capital city as far away as Tbilisi in Georgia, Airbnb has over 30 competitors!

In every country a vast array of companies and brands are becoming active in this space – large, quality competitors with networks and websites listed in industry reports from Research & Markets include: 9Flats, Tripping, Windu, FlipKey, House Trip, OnlineVacationRentals, Rentalo, VBRO, House Trip, VayStays, VacayHero, Roomorama, Villas International, Villas.com, At Home Abroad, PerfectPlaces, OneFineStay, FlipKey and Couchsurfing.

And more and more travel groups are seeing the market as one to get into, ranging in size from Priceline to Choice Hotels. Across all research, however, Homeaway (bought last year by Expedia for $3.9 billion) usually comes up as Airbnb’s largest direct competitor.

Research & Markets says the global vacation rental industry is currently worth around $100 billion and it expects this to almost double in the next few years, reaching $170 billion in 2019. Currently, the US is the largest single market, taking around 25% of the total.

Read rest of the article at Eye for Travel