Since 2007, when Airbnb was created, the U.S. lodging industry has experienced a rapid increase in both traditional hotel demand and lodging demand occurring in the sharing economy. Airbnb has become a dominant channel for listing available lodging units in the sharing economy.[1] In this article, Hotel Appraisers & Advisors (HA&A) estimates Airbnb’s market share of U.S. lodging demand, measured by room nights booked. We also discuss historical growth rates and the recent deceleration of Airbnb’s demand growth pace.

HA&A collaborated with AirDNA[2] and relied on numerous other data providers, such as STR, Statista, Venturebeat, and other confidential sources, as well as our own proprietary estimation models, to develop the estimates shown in this report. Airbnb denied multiple requests to share data that would confirm various estimates shown throughout this report. Although we believe estimates in this report are accurate, they should not be relied on for investment decisions.

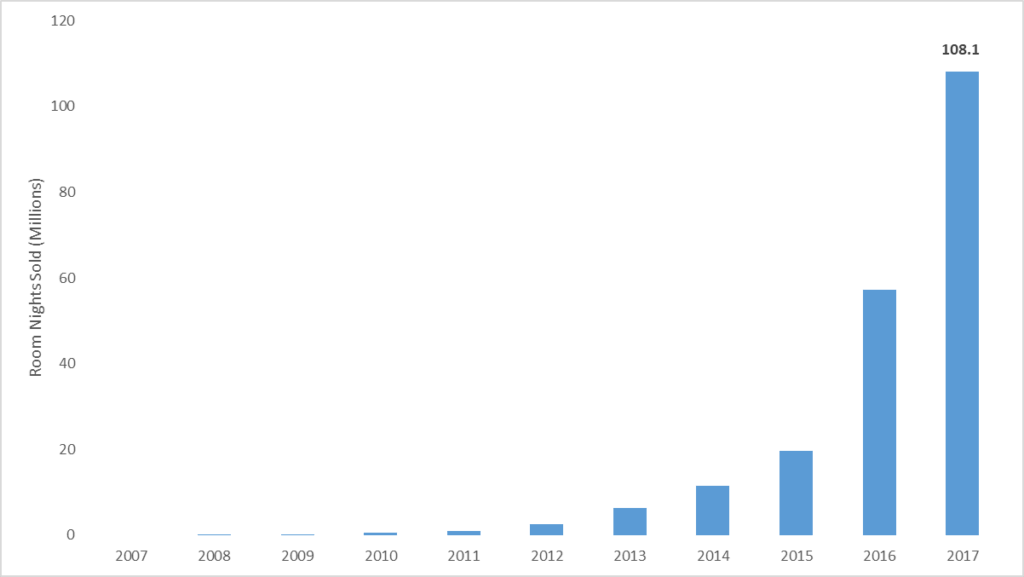

The following figure illustrates our estimate of Airbnb’s U.S. lodging demand growth from 2007 through 2017.

According to estimates from AirDNA, the total number of U.S. room nights booked through Airbnb in 2017 was approximately 108.1 million. Demand has grown rapidly during the past few years. However, we expect demand growth will decelerate in the near term. Recent monthly data from AirDNA provides strong evidence that this is already happening. Specifically, the pace of growth in room nights sold has declined over the course of the past year, even though demand is still growing significantly. We expect the pace of demand growth will continue to decelerate during the next few years.

The following figure illustrates how the pace of Airbnb’s demand growth has decelerated in 2017 and 2018, after accelerating rapidly throughout much of 2015 and 2016.